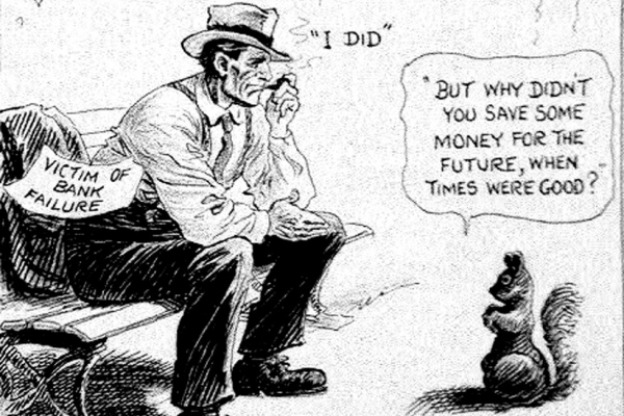

The causes of the market crash is a twofold. Borrowing over 6 million dollars from speculators put the banks in severe debt, which in turn, inhibited ts customers from withdrawing their money. Secondly, numerous banks invested depositors’ money in the stock market, with the hopes of receiving a higher return so that they could use the money for future loans.

http://www.loc.gov/pictures/item/acd1996005778/PP/

The success of a market is contingent to the financial input of its current investors. New customers also play a fundamental role in the banks business, without them its impossible for the bank to branch out. The great crash of 1929 is the perfect archetype of all financial disasters because it exposed all of the holes in the American economy that needed to be patched. President Hoover did too little too late but President F.D. Roosevelt is credited with lasting reform in the banking system such as the FDIC.

Related articles

Stock Market Crash 1929

When Even The New York Times Understood Speculative Bubbles: Its Diagnosis Of The 1929 Crash Was Very Fit To Print

How the Artificial Boom of 1914-1929 Caused the Great Depression