First of all, you need to know that if you work the whole of 2016 you will need to file your income taxes at this time. Maybe you have get your W-2 delivered in the mail to your home. With that paper you can begin to do your taxes but it is not that simple. Taxes are due on April 17, 2017. So if you need to do your taxes please ask a resident who knows about taxes and ask them to explain more about the taxes.

Many of people of the United States know what taxes are about. Maybe there is someone that doesn’t know what it is. or maybe many immigrants don’t know about what it is and the importance that it has. To live in the United States you have to know that you must have your taxes in order since you are living here. There are many immigrants who actually want to pay taxes if that means it will help them get citizenship and many actually do pay taxes even though they are not citizens.

Many people who came from other countries and their are illegals may be think that just because of their situations they don’t need to do taxes, but they’re wrong because it doesn’t matter that they don’t have a Social Security Number. They can get a ITIN (Tax ID) this ITIN is provided to people that don’t qualify for a SSN and they want to do their taxes. It is very important for the government of the United Stated that every single person in this country report how much they gain and spend in the year.

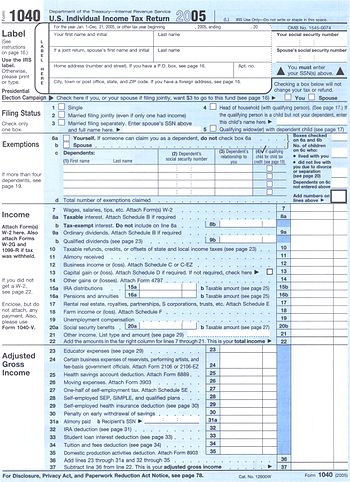

The first form that you receive is your W-2. You will receive this from your employer. It is a form that states the wages and taxes that you have paid over the year. If you have worked more than one job you will need to receive a W-2 from each employer. You may need to check to make sure your employers have your current address. If you have worked as an independent contractor, you will not receive a W-2 since you are responsible for paying your own taxes. Many people likes to do taxes because they get a refund, but others doesn’t like it because they have to pay to the IRS.

Sometimes people who don’t posses a Social Security Number just think that they will not get in trouble if they don’t report their taxes but they are wrong, because if in the future they want to be legal they will have problems with the IRS. They have to pay a certain amount of money depending on how many years they live in the U.S. without reporting their taxes.

https://www.thebalance.com/residents-immigrants-tax-return-3193100

Ddtnc • Mar 22, 2017 at 2:41 pm

I didn’t know what we supposed to do to make the taxes but someone help me because I have never do taxes. But taxes it very important that u do it and if you don’t have a social you could used a IRS number to do taxes.